advantages of sst in malaysia

It stands for 10. Sales Tax 5 for fruit juices basic foodstuffs building.

A192 Ch4 Methods Of Re Part2 Students Pptx Bwrr3153 Chapter 4 Methods Of Reinsurance Proportional Part Ii A B C D E F G Retention Course Hero

GST is also a transparent form of.

. SST to give consumers higher purchasing power SST is only taxable on 38 per cent of the consumer price index basket of goods and services compared. There are some advantage and give the good effect to the society. Manufacturers will be forced to be more.

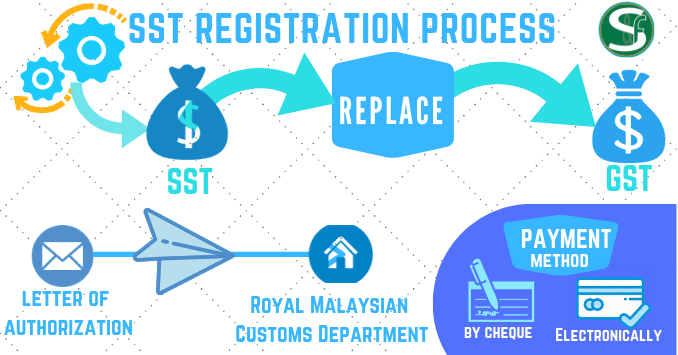

MALAYSIAs decision to revert to the Sales and Service Tax SST from the Goods and Services Tax GST will result in a higher disposable income due to relatively lower prices it will incur in. Sales and Services Tax SST The Sales Tax is only imposed on the manufacturer level the Service Tax is imposed on consumers that are using tax services. In general SST will increase prices of certain items as its only imposed on selected items while GST is imposed on every goods and sales.

SST is an ad-valorem tax that is calculated through percentage in proportion to the estimated value of the sales or services. SST the pros and cons By BOON OON SEANG Business Thursday 11 Sep 2003 THE introduction of sales and service tax SST in Malaysia has been talked about since the early. The sales tax and the other one the service tax Sales Tax Sales tax is only applicable to taxable goods that are manufactured or.

The overall cost of doing business because of this as a result becomes lower which will in turn help the export sector be more competitive. SST Sales and Service Tax consists of two separate taxes. The new sales tax will be imposed at a rate of either 5 10 or a specific amount will be for petroleum products.

Thursday 11 Sep 2003 1200 AM MYT THE introduction of sales and service tax SST in Malaysia has been talked about since the early 1980s when a group of civil servants from the Treasury. One expected benefit from the SST is a lower cost of living as sales tax is charged just once by the manufacturer at the point of sale. Sales and service tax SST has been doing well in Malaysia before it was replaced a few years back.

The earlier taxation structure ie sales and service. SST is a simple and straightforward tax regime where businesses do not need to spend time and effort on calculating GST refunds. SST in Malaysia and How It Works.

Director for small enterprises at Kuala Lumpur Malaysia Author has 1K answers and 8502K answer views 3 y the advantages for SST are. Currently stands at 325. As such they can allocate more resources on productive.

Benefits of SST The general consensus is that with SST back in the system some prices have seen a decrease but it remains to be seen whether prices will stay that way as. The advantages for SST are. If the authorities can oversee this matter effectively the SST will certainly bring more benefits than GST he explained.

The SST-02 return must be submitted. It is a single stage tax imposed on factories or. SST rates are less.

Rate could go up to 35 in the whole of 2019. The SST consists of 2 elements. Goods and Service Tax in Malaysia is a single taxation system in the economy levied on all goods and services in the country.

The first taxable period will be from September to October 2018. Companies who are SST-registered must file a report every two months. ADVANTAGES OF GST Goods and service tax GST is a good tax system that has been applied in Malaysia and some country.

Advantages of sst in malaysia As well as these advantages Brooks stair lifts are not obtrusive to others as they have a slim-line design which enables others to use the stairs as normal. The service tax rate will be. GST will increase governments revenue.

Sales And Service Tax Malaysia 2020 Onward Sst Malaysia

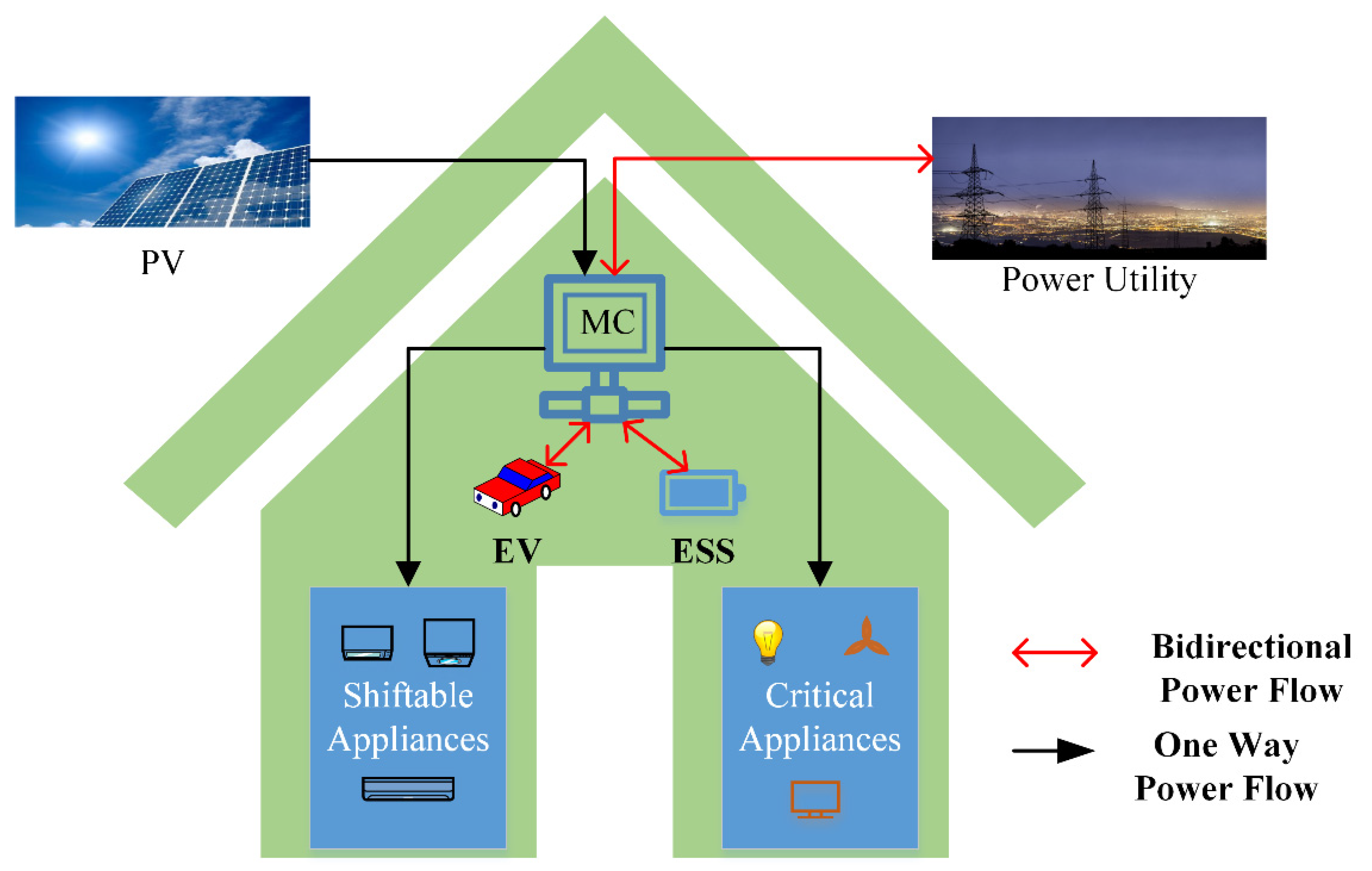

Energies Free Full Text Integration Of Electric Vehicles And Energy Storage System In Home Energy Management System With Home To Grid Capability Html

Malaysia Qualified Gst Tax Agent Chartered Accountant And Consultant

3 Things To Know About Sst To Maximise Your Tax Advantage Denyo United Machinery

Comparison Of Tax Burden Under Sst And Gst Download Scientific Diagram

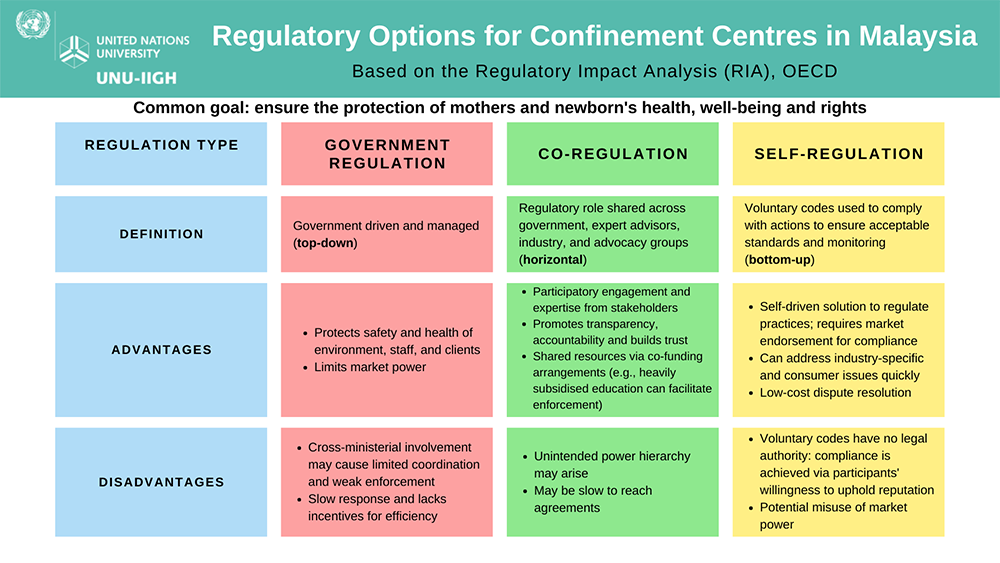

Confinement Centres In Malaysia Addressing The Challenges Of Providing The Best Care For Mothers And Newborns International Institute For Global Health

Sales And Service Tax Malaysia 2020 Onward Sst Malaysia

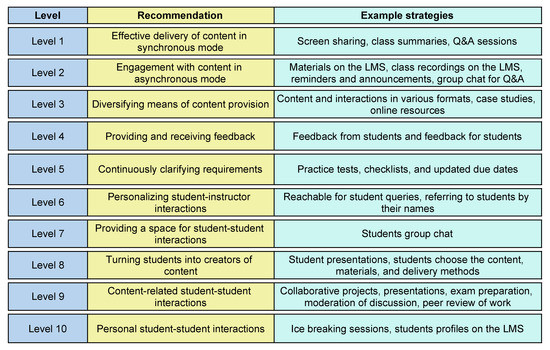

Pei Lee Teh Head Of Department Associate Professor Bit Mm Phd Monash University Malaysia Victoria School Of Business

Education Sciences January 2021 Browse Articles

Malaysia Sst Advisory Planning Malaysia Tax Accounting Consulting Firm

Comparison Of Tax Burden Under Sst And Gst Download Scientific Diagram

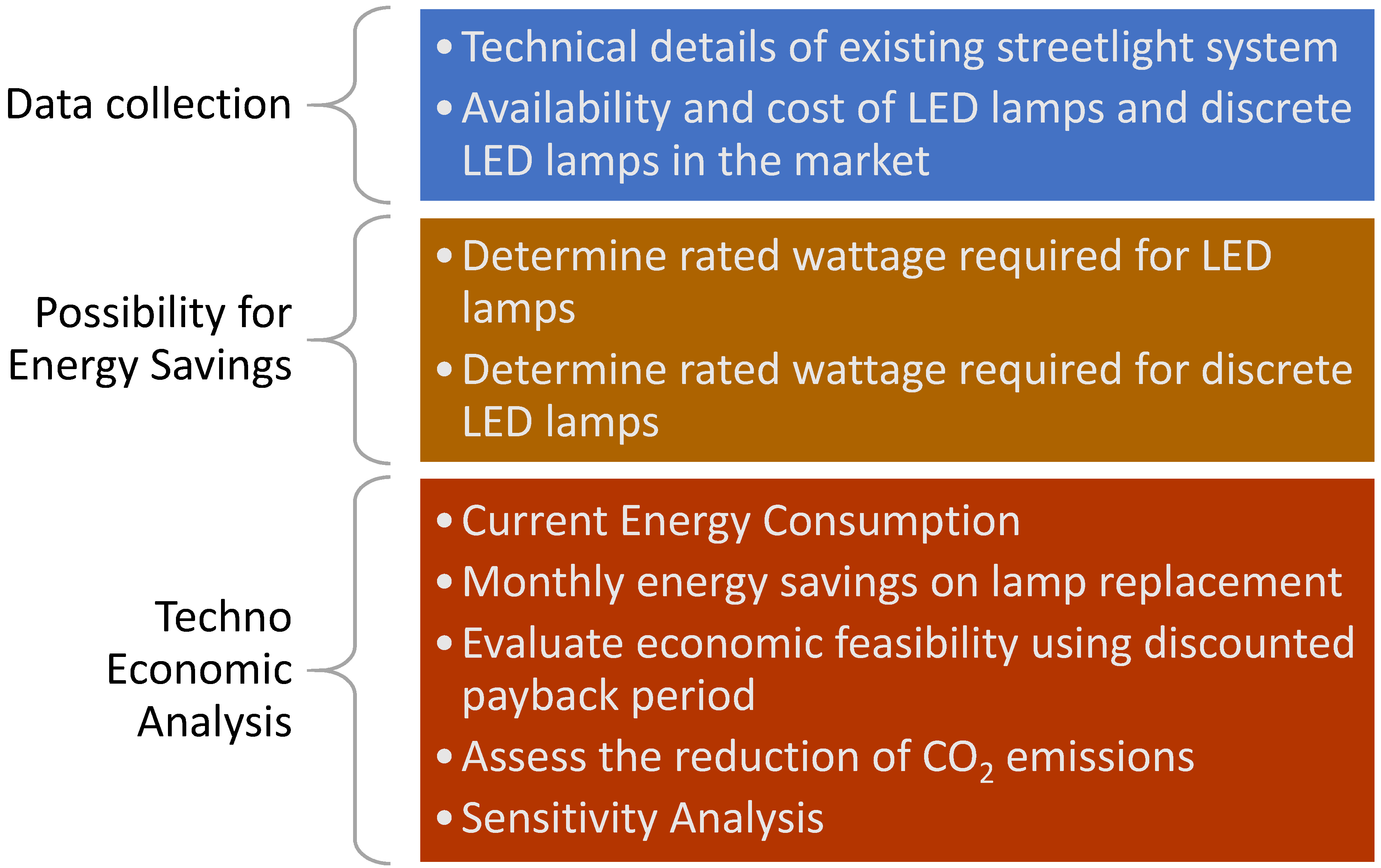

Energies Free Full Text Economic Analysis Of Replacing Hps Lamp With Led Lamp And Cost Estimation To Set Up Pv Battery System For Street Lighting In Oman Html

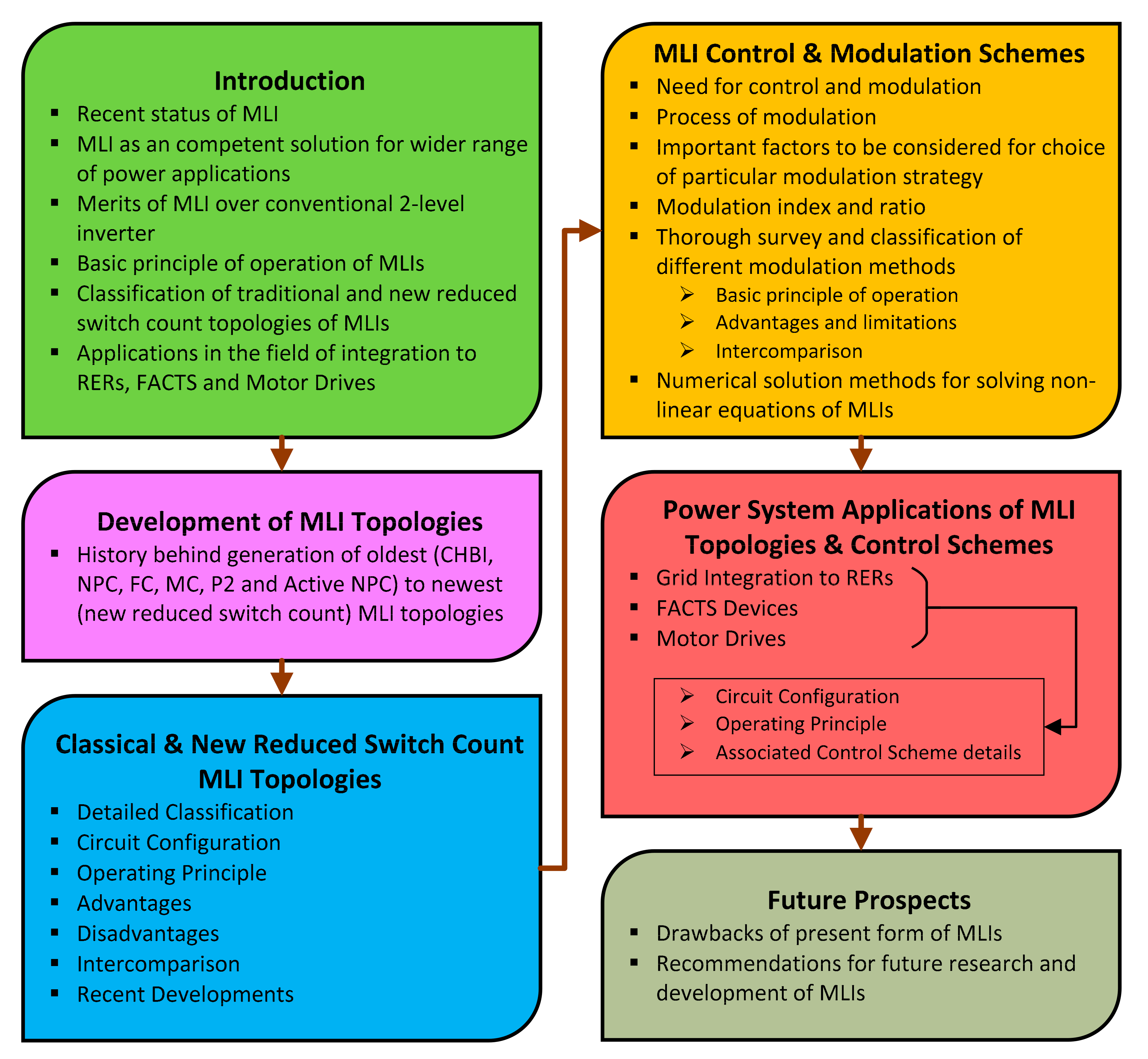

Energies Free Full Text Multilevel Inverter A Survey On Classical And Advanced Topologies Control Schemes Applications To Power System And Future Prospects Html

Sales And Service Tax Malaysia 2020 Onward Sst Malaysia

Malaysia Sst Advisory Planning Malaysia Tax Accounting Consulting Firm

Comments

Post a Comment